How Will the Election Impact Your Investments?

Click here to see the complete article (4 pages).

Seeing Past the Myths

As the Presidential election campaigns hit full swing, many people are wondering what impact the election will have on their investments. In this white paper, we discuss how history shows that election outcomes rarely have a lasting effect on the market and that staying the course and pursuing long-term financial goals may be the best option for most investors.

Don’t Bet Your Financial Security on Election Predictions

In 1948, Thomas Dewey was overwhelmingly favored to win the White House from the incumbent, President Harry S. Truman. Early on Election Night, the Chicago Tribune declared Dewey the winner, only to see Truman score a historic upset. Over the next two weeks, stocks fell by more than 10%, frustrating investors who had expected to profit from a predicted post-election surge. This example is a cautionary tale about the futility of using elections as a guide for how to invest.

Separating Myth from Fact

Every four years we must separate myths from facts. The bottom line is that elections have not been a predictive indicator into the market’s performance. In the run-up to a Presidential election, there are simply too many unknowns to predict voting patterns and outcomes with accuracy. At any point, unforeseen events in the U.S. or abroad can have a powerful and disruptive effect on voter preferences. Given the lack of certainty, it’s not surprising that a wide array of myths and misconceptions have arisen about the impact of elections on investments. Some have persisted for years, as can be seen from the charts on the next page.

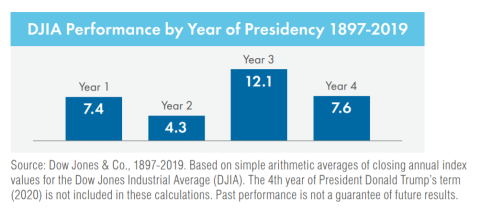

- MYTH: Market performance improves just before and after a presidential election.

- FACT: Markets have generally been strongest during the third year of a presidential term.

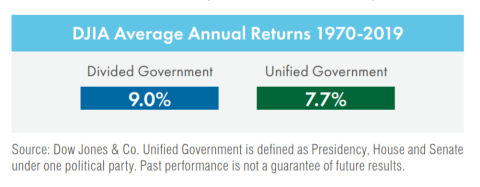

- MYTH: Markets rise when the same party holds the Presidency and both houses of Congress.

- FACT: Over the last 50 years, returns have outperformed under a divided government.

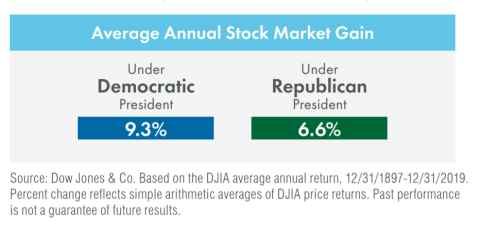

- MYTH: The economy and the markets always do better under Republicans.

- FACT: There is no proven link between market performance and which party is in power.

Now there are some historic patterns that hold up to scrutiny. For example, the S&P 500 has had a positive return in all but four presidential election years (1932, 1940, 2000, 2008) since 1928. But while such trends may be interesting, they aren’t especially useful and should not be viewed as a formula for predicting the impact of an election on your portfolio. The truth is that no such formula exists. Nonetheless, there are steps you can take to protect your financial goals and keep your strategy on course amid the tumult and uncertainty of an election year.

Do Elections Really Drive Market Movements?

Rhetoric, promises, claims and counterclaims fly freely during an election campaign. This year, the picture is more cloudy than usual, but market behavior transcends politics and election results, driven instead by long-term factors like economic growth, inflation and monetary policy. Presidents have far less influence on share prices and the economy than people credit—or blame—them for. That said, there are market and economic forces now gathering steam, apart from the election, that could have relevance to your investment—irrespective of which party wins.

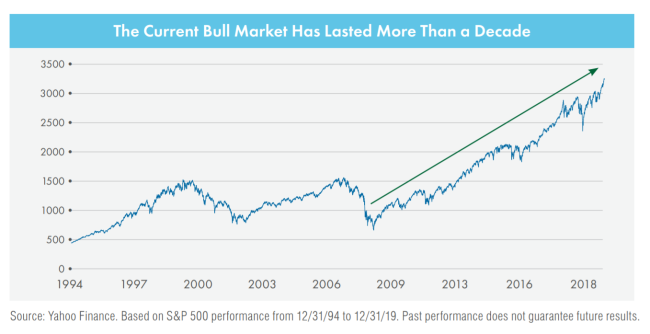

- A Potential Market Correction

- The current bull market is in its 12th year and has continued to reach new heights. However, bull markets don’t run forever. Markets naturally move through a cycle of expansion, contraction, recession and recovery. Investors are concerned about a potential correction, which is defined as a drop of 10% or more. The question is not when but how much.

- Recession Fears

- Recessions should not be feared due to an election year, but rather due to underlying economic strength or weakness. The signs are there that a recession may be on the horizon. For example,

the yield on the 10-year U.S. Treasury note recently traded lower than that of the 2-year note. This inverted yield curve is viewed by many economists as a harbinger of a future recession. An inverted yield curve has preceded every recession over the past 50 years.

- Recessions should not be feared due to an election year, but rather due to underlying economic strength or weakness. The signs are there that a recession may be on the horizon. For example,

- Declining Interest Rates

- The effects of declining interest rates are already being felt. The Federal Reserve has made several attempts to help support the economy by lowering the Fed Funds rate. With rates near record lows, yield has grown scarce and investors face the challenge of finding new sources of income to fund their retirement and meet expenses.

Strategies for Addressing Today’s Market Challenges

A Presidential election, market correction, recession or further drop in interest rates should not push your goals out of reach. Even in a constrained market, there are strategies that you can implement to help generate income, tamp down risk and keep moving towards achieving your goals. Consider these three strategies:

- Diversification

- A diversified portfolio is considered to be less vulnerable to market swings than any one sector or asset class, potentially enabling you to weather periods of short-term volatility. While diversification does not provide a guarantee against financial loss, spreading your investments across different asset categories, industries and countries may help lessen risk and give you the confidence to stay fully invested during periods of uncertainty.

- Multi-Asset Fixed Income

- In the current low interest rate environment, a flexible portfolio of different types of fixed income asset classes has the potential to outperform traditional bonds and Treasuries. These could include senior floating rate bank loans, investment grade and high-yield corporate bonds, as well as domestic and international securities—all geared toward enhancing income and generating attractive risk-adjusted returns, regardless of which way interest rates are expected to move.

- Dividend-Paying Stocks

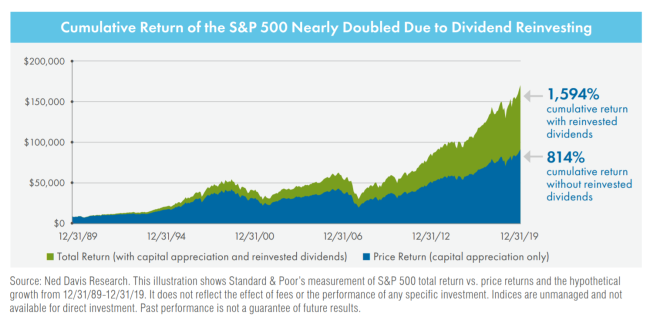

- Stock dividends can be a powerful driver in building long-term wealth. Large, established companies with strong balance sheets and histories of paying consistent dividends often outperform the overall markets, including during periods of market downturns. As the chart below shows, dividends have accounted for more than half of the total return of the S&P 500 Index over the past 30 years.

Positioning Your Portfolio in an Election Year

Election campaigns generate noise, uncertainty and a lot of information to process. But little of it should have any bearing on your investment goals and strategy. While many investors are positioning their portfolios for a particular election outcome, history suggests that it may be more prudent to focus on market fundamentals and investment goals.

It’s crucial to look beyond the headlines, promises and hype—to put a plan in place based on your objectives, situation and risk tolerance, monitor it regularly and stay fully invested. An experienced financial advisor can help you avoid the emotional ups and downs of investing in today’s market. Offering expertise and objectivity, an advisor can help you put it all in perspective and implement an investment strategy that’s right for you, regardless of what happens on Election Day.

For more information about this whitepaper or AIG Funds, please contact us or visit aig.com/funds.

Important Information

The content of this whitepaper is provided for informational purposes only. It is not intended to represent the recommendation to buy or sell any particular security or investment. Past performance is not indicative of future results.

Investments in stocks involve risk, including the possible loss of principal. Dividend-paying stocks offer current income, along with the potential for capital appreciation. Dividend income is not guaranteed and may vary depending on market performance, and may be taxed as either ordinary income or capital gains. Dividend yield is one component of performance and should not be the only consideration for investment. Investment results will vary. Non-dividend-paying stocks offer only the potential for capital appreciation. When stocks are sold, investors may pay tax at either the ordinary income tax rate or the long-term capital gains tax rate. Please discuss with your financial advisor the benefits and risks of investing in these securities. Interest rates and bond prices typically move inversely to each other; therefore, as with any bond investment, the value of an investment may go up or down in response to changes in interest rates. Bank loans will fluctuate and may lose value. Investment in bank loans involves certain risks, including, among others: risks of nonpayment of principal and interest; collateral impairment; non-diversification and borrower industry concentration; and lack of full liquidity. High-yield bonds tend to have lower interest rate risk than higher-quality bonds of similar maturity but carry greater credit and default risk. Investing internationally involves special risks, such as currency fluctuations, and economic and political instability. Please discuss with your financial advisor the benefits and risks of investing in these types of securities and before investing in any particular investment style or approach.

The Dow Jones Industrial Average (DJIA) is a price-weighted average of 30 actively traded “blue chip” stocks, primarily industrials, but also including financial and other service-oriented companies. The S&P 500 Index is an unmanaged, broad-based, market-cap weighted index of 500 U.S. stocks. Investors cannot invest directly in an index.

Investors should carefully consider a fund’s investment objectives, risk, charges and expenses before investing. The prospectus, containing this and other important information can be obtained from your financial advisor, the AIG Funds Sales Desk at 800-858-8850, ext. 6003, or at aig.com/funds. Investors should read the prospectus carefully before investing.

AIG Funds are advised by SunAmerica Asset Management, LLC (SAAMCo) and distributed by AIG Capital Services, Inc. (ACS), Member FINRA. Harborside 5, 185 Hudson Street, Suite 3300, Jersey City, NJ 07311, 800-858-8850. SAAMCo and ACS are members of American International Group, Inc. (AIG).

Not FDIC or NCUA/NCUSIF Insured

- May Lose Value

- No Bank or Credit Union Guarantee

- Not a Deposit

- Not Insured by any Federal Government Agency

Click here to see the complete article.